In Realtor.com’s recent article, “Home Buyers’ Top Mortgage Fears: Which One Scares You?” they mention that “46% of potential home buyers fear they won’t qualify for a mortgage to the point that they don’t even try.”

Myth #1: “I Need a 20% Down Payment”

Buyers overestimate the down payment funds needed to qualify for a home loan. According to the First Quarter 2017 Homeownership Program Index (HPI)from Down Payment Resource, saving for a down payment was the barrier that kept 70% of renters from buying.

Rob Chrane, CEO of Down Payment Resource, had this to say:

“There are many mortgage-ready renters today, but they don’t know it. Often, homebuyers remain sidelined for years due to the down payment.”

Many believe that they need at least 20% down to buy their dream home, but programs are available that allow buyers to put down as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged, allowing less cash out of pocket.

Myth #2: “I need a 780 FICO® Score or Higher to Buy”

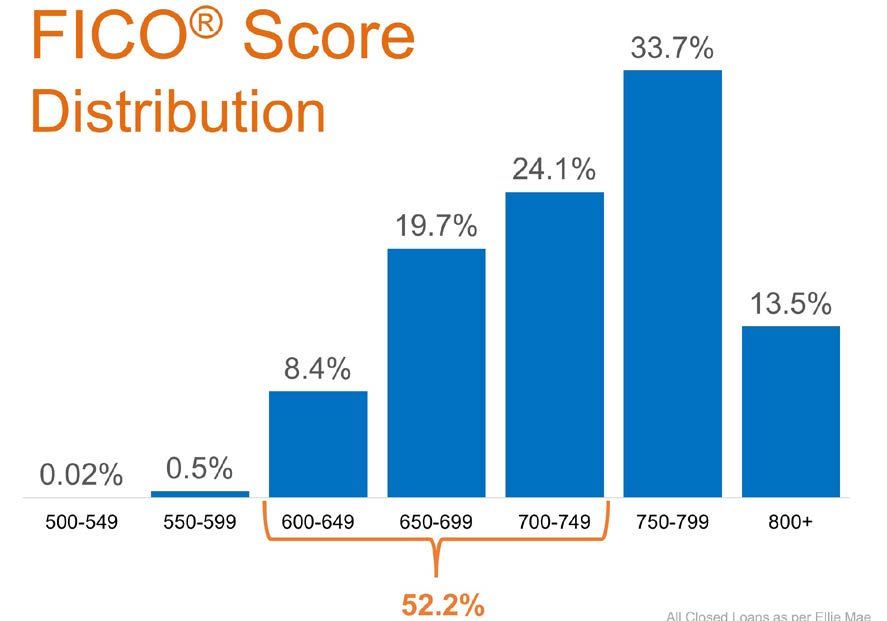

The survey revealed that 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO® score is necessary to qualify.

Many Americans believe

a ‘good’ credit score is 780

or higher.

To help debunk this myth,

let’s take a look at Ellie

Mae’s latest Origination

Insight Report, which

focuses on recently closed

(approved) loans.

As you can see on the right, 52.2% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.